伯克希尔哈撒韦 世界最高的股价 却很便宜(下)

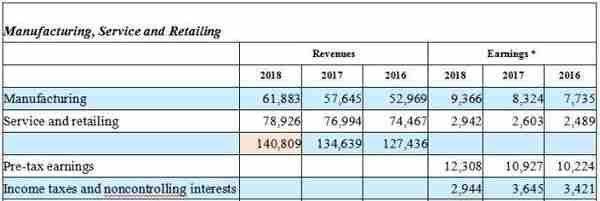

8、制造业、服务业和零售业

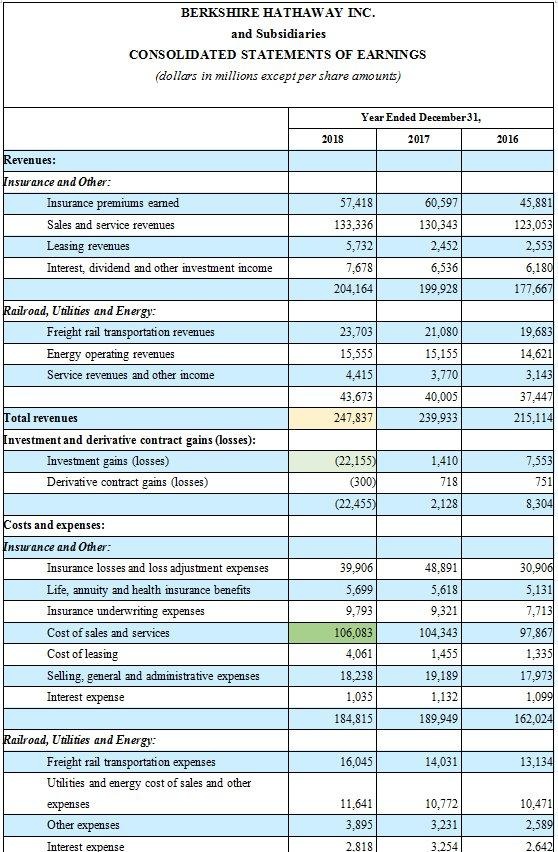

2018 年,伯克希尔公司制造业、服务业和零售业收入为1409.09亿元,其中制造业收入为618.83亿美元,占比43.92%;服务业营业收入为789.26亿元,占比56.01%。

2018年伯克希尔公司的营业收入为2254亿美元,伯克希尔公司制造业、服务业和零售业的收入总额占公司营业收入总额的62.52%。

在利润方面,2018年公司制造业和服务业的税前利润为123.08亿美元,其中制造业税前利润为93.66亿美元,占比76.1%;服务业和零售业税前利润为29.42亿美元,占比23.9%。

2018年公司制造业和服务业的利润为93.64亿美元。

根据2016年数据,公司制造业、服务业和零售业利润为68.03亿元,而公司净利润为240.7亿元,制造业、服务业和零售业利润占比28.26%。

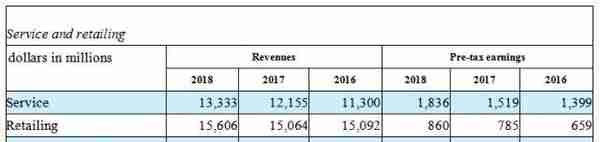

2018年伯克希尔公司的服务业收入高达133.33亿美元,占公司营业收入的5.9%;

2018年,伯克希尔公司拟的零售业务的收入高达156.06亿美元,占公司营业收入的6.9%;

McLane Company的营业收入高达499.87亿美元,占伯克希尔公司营业收入的22.17%。

9、服务

Our service business group offers fractional ownership programs for general aviation aircraft (NetJets) and high technology training to operators of aircraft (FlightSafety). We also distribute electronic components (TTI) and franchise and service a network of quick service restaurants (Dairy Queen). Other service businesses include transportation equipment leasing (XTRA) and furniture leasing (CORT), electronic news distribution, multimedia and regulatory filings (Business Wire), publication of newspapers and other publications (Buffalo News and the BH Media Group) and operation of a television station in Miami, Florida (WPLG). We also offer third party logistics services that primarily serve the petroleum and chemical industries (Charter Brokerage).

公司的服务业务集团为通用航空飞机(NetJets)提供部分所有权项目,并为飞机运营商(FlightSafety)提供高科技培训。公司还经销电子元件(TTI),特许经营和服务快速服务餐厅(乳制品皇后区)网络。其他服务业务包括运输设备租赁(XTRA)和家具租赁(CORT)、电子新闻发布、多媒体和监管文件(商业电报)、报纸和其他出版物的出版(Buffalo News和BH Media Group)以及佛罗里达州迈阿密的一家电视台的运营(WPLG)。我们还提供第三方物流服务,主要服务于石油和化学工业(包机经纪)。

Berkshire’s service businesses employ approximately 51,000 people. Information concerning these activities follows.

伯克希尔的服务业雇佣了大约5.1万人。

Revenues of the service group were approximately $13.3 billion in 2018, an increase of approximately $1.2 billion (9.7%) compared to 2017. TTI’s revenues in 2018 increased approximately 33.7% compared to 2017, reflecting industry-wide increases in demand for electronic components in many geographic markets around the world, and the effects of recent business acquisitions and favorable foreign currency translation effects.

在2018,服务集团的收入约为133亿美元,同比增长9.7%。TTI在2018的收入增加了大约33.7%,这反映了全球范围内许多地区的电子组件的行业需求的增加,以及最近的商业并购和有利的外币转换效果的影响。

While TTI’s revenue increase in 2018 was significant, revenue growth began to moderate in the fourth quarter, in part attributable to the impact of U.S. trade tariffs.

虽然TTI在2018年的收入增长显著,但第四季度收入增长开始放缓,部分原因是美国贸易关税的影响。

WPLG generated a revenue increase of 20.8% in 2018 over 2017, primarily due to increased political advertising revenue. Revenues of Charter Brokerage increased 53.3%, reflecting increased fees and product mix changes.

WPLG在2018年的收入增长了20.8%,主要原因是政治广告收入的增加。特许经纪业务收入增长53.3%,反映出费用增加和产品结构变化。

Revenues of our leasing businesses increased 8.4% in 2018 compared to 2017 due to increased over-the road trailer units on lease (XTRA) and increased furniture rental income (CORT).

2018年公司的租赁业务收入增长了8.4%,原因是租赁的道路拖车单元(XTRA)和家具租赁收入(CORT)增加。

Pre-tax earnings of the service group in 2018 were approximately $1.8 billion, an increase of $317 million (20.9%) compared to 2017. The comparative earnings increase was primarily due to TTI, which accounted for almost 84% of the increase.

在2018,服务集团的税前利润约为18亿美元,同比增长20.9%。主要是由于TTI,占增长的近84%。

【McLane Company】

McLane operates a wholesale distribution business that provides grocery and non-food consumer products to retailers and convenience stores (“grocery”) and to restaurants (“foodservice”).

McLane经营批发分销业务,向零售商和便利店(“杂货店”)以及餐厅(“餐饮服务”)提供食品和非食品消费品。

McLane also operates businesses that are wholesale distributors of distilled spirits, wine and beer (“beverage”). The grocery and foodservice businesses generate high sales and very low profit margins. These businesses have several significant customers, including Walmart, 7-Eleven, Yum! Brands and others. Grocery sales comprised approximately 67% of McLane’s consolidated sales in 2018 with food service comprising most of the remainder. A curtailment of purchasing by any of its significant customers could have an adverse impact on periodic revenues and earnings.

麦克莱恩还经营蒸馏酒、葡萄酒和啤酒(“饮料”)的批发经销商业务。杂货和食品服务业务产生了高销售额和极低的利润率。这些企业有几个重要客户,包括沃尔玛、7-11、百胜!品牌和其他。食品杂货销售额占McLain 2018的综合销售额的67%,其中包括大部分剩余的食品服务。任何重要客户的采购缩减都可能对定期收入和收益产生不利影响。

McLane provides wholesale distribution services to Walmart, which accounts for approximately 22% of McLane’s revenues. McLane’s other significant customers include 7-Elevenand Yum! Brands, each of which accounted for approximately 11% of McLane’s revenues in 2018.

麦克莱恩为沃尔玛提供批发分销服务,来至沃尔玛的收入约占麦克莱恩总收入的22%。McLane的其他重要客户包括7-Elevenand Yum!品牌,这个品牌在2018年约占麦克莱恩收入的11%。

McLane Company, Inc. (“McLane”) provides wholesale distribution services in all 50 states to customers that include convenience stores, discount retailers, wholesale clubs, drug stores, military bases, quick service restaurants and casual dining restaurants.

麦克莱恩公司在所有50个州向客户提供批发分销服务,包括便利店、折扣零售商、批发俱乐部、药店、军事基地、快速服务餐厅和休闲餐厅。

McLane’s business model is based on a high volume of sales, rapid inventory turnover and stringent expense controls. Operations are currently divided into three business units: grocery distribution, foodservice distribution and beverage distribution.

麦克莱恩的商业模式是基于高销售量、快速的库存周转和严格的费用控制。业务目前分为三个业务部门:杂货配送、餐饮配送和饮料配送。

McLane’s grocery distribution unit, based in Temple, Texas, maintains a dominant market share within the convenience store industry and serves most of the national convenience store chains and major oil company retail outlets. Grocery operations provide products to approximately 50,000 retail locations nationwide, including Walmart. McLane’s grocery distribution unit operates 23 distribution facilities in 20 states.

麦克莱恩位于德克萨斯州坦普尔市的杂货配送部门在便利店行业保持着主导市场份额,为大多数国家便利店连锁店和主要石油公司零售店提供服务。杂货店业务向全国大约5万个零售点提供产品,包括沃尔玛。麦克莱恩的杂货配送部门在20个州经营23个配送设施。

McLane’s foodservice distribution unit, based in Carrollton, Texas, focuses on serving the quick service and casual dining restaurant industry with high quality, timely-delivered products. Operations are conducted through 47 facilities in 22 states. The foodservice distribution unit services approximately 35,200 restaurants nationwide.

McLane位于德克萨斯州卡罗尔顿市的餐饮服务配送部门专注于为快餐和休闲餐饮行业提供优质、及时的产品。运营通过22个州的47个设施进行。餐饮配送部为全国约3.52万家餐厅提供服务。

Through its subsidiaries, McLane also operates several wholesale distributors of distilled spirits, wine and beer. Operations are conducted through 14 distribution centers in Georgia, North Carolina, Tennessee and Colorado. These beverage units operating as Empire Distributors, Empire Distributors of North Carolina, Empire Distributors of Tennessee and Baroness Small Estates, service approximately 25,300 retail locations in the Southeastern United States and Colorado.

麦克莱恩还通过其子公司经营蒸馏酒、葡萄酒和啤酒的多家批发经销商。业务通过乔治亚州、北卡罗来纳州、田纳西州和科罗拉多州的14个配送中心进行。这些饮料部门作为帝国分销商、北卡罗来纳州帝国分销商、田纳西州帝国分销商和小庄园男爵夫人运营,服务于美国东南部和科罗拉多州约2.53万个零售点。

McLane’s revenues were approximately $50.0 billion in 2018;

2018,McLane的收入约为500亿美元。

【FlightSafety International】

FlightSafety International Inc. (“FlightSafety”), headquartered at New York’s LaGuardia Airport, is an industry leader in professional aviation training services to individuals, businesses (including certain commercial aviation companies) and the U.S. government and certain foreign governments.

飞行安全国际公司总部位于纽约拉瓜迪亚机场,是一家为个人、企业(包括某些商业航空公司)、美国政府和某些外国政府提供专业航空培训服务,是行业领先者。

FlightSafety is also a leader in the design and manufacture of full flight simulators, visual systems, displays and other advanced technology training devices. This equipment is used to support FlightSafety training programs and is offered for sale to airlines and government and military organizations around the world. Manufacturing facilities are located in Oklahoma, Missouri and Texas.

飞行安全国际公司也是全飞行模拟器、视觉系统、显示器和其他先进技术培训设备的设计和制造的领导者。该设备用于支持飞行安全公司培训计划,并出售给世界各地的航空公司、政府和军事组织。制造工厂位于俄克拉荷马州、密苏里州和德克萨斯州。

【NetJets】

NetJets Inc. (“NetJets”) is the world’s leading provider of shared ownership programs for general aviation aircraft. NetJets’ global headquarters is located in Columbus, Ohio, with most of its logistical and flight operations based at Port Columbus International Airport.

NetJets Inc.是全球领先的通用航空飞机共享所有权计划提供商。NetJets的全球总部位于俄亥俄州哥伦布市,大部分后勤和飞行业务都设在哥伦布港国际机场。

NetJets’ European operations are based in Lisbon, Portugal. The shared ownership concept is designed to meet the travel needs of customers who require the scale, flexibility and access of a large fleet that whole aircraft ownership cannot deliver. In addition, shared ownership programs are available for corporate flight departments seeking to outsource their general aviation needs or add capacity for peak periods and for others that previously chartered aircraft.

NetJets的欧洲业务总部位于葡萄牙里斯本。共享所有权的概念是为了满足客户的旅行需求,这些客户需要一个大型机队的规模、灵活性和访问权限,而整个飞机所有权无法满足这些需求。

【TTI, Inc.】

TTI, Inc. (“TTI”), headquartered in Fort Worth, Texas, is a global specialty distributor of passive, interconnect, electromechanical, and discrete components used by customers in the manufacturing and assembling of electronic products.

TTI公司总部位于得克萨斯州沃思堡,是一家全球专业分销商,为客户生产和组装电子产品提供无源、互连、机电和分立元件。

TTI operates sales offices and distribution centers from more than 100 locations throughout North America, Europe, Asia and Israel.

TTI在北美、欧洲、亚洲和以色列的100多个地区设有销售办事处和配送中心。

【XTRA Corporatn】

XTRA Corporatn (“XTRA”), headquartered in St. Louis, Missouri, is a leading transportation equipment lessor operating under the XTRA Lease® brand name. XTRA manages a diverse fleet of approximately 82,000 units located at 51 facilities throughout the United States. The fleet includes over-the-road and storage trailers, chassis, temperature controlled vans and flatbed trailers. XTRA is one of the largest lessors (in terms of units available) of over-the-road trailers in North America.

xtra公司总部位于密苏里州圣路易斯市,是一家领先的运输设备出租公司,以xtra lease®品牌运营。xtra管理着一支由大约8.2万个单位组成的多元化车队,分布在美国的51个工厂。车队包括公路和储存拖车、底盘、温控货车和平板拖车。xtra是北美最大的公路拖车出租公司之一。

【International Dairy Queen】

International Dairy Queen develops and services a worldwide system of over 6,900 stores operating primarily under the names DQ Grill and Chill®, Dairy Queen® and Orange Julius® that offer various dairy desserts, beverages, prepared foods and blended fruit drinks. Business Wire provides electronic dissemination of full-text news releases to the media, online services and databases and the global investment community in 150 countries and in 45 languages. Approximately 97% of Business Wire’s revenues derive from its core news distribution business.

国际乳制品皇后区在全球范围内开发和服务了6900多家商店,主要以“DQ Grill and Chill”、“ Dairy Queen”和“Orange Julius”的名称运营,提供各种乳制品甜点、饮料、准备食品和混合水果饮料。以45种语言向150个国家的媒体、在线服务和数据库以及全球投资界提供全文新闻稿的电子传播。Business Wire大约97%的收入来自其核心新闻发布业务。

【CORT Business Services Corporation】

CORT Business Services Corporation is a leading national provider of rental relocation services including rental furniture, accessories and related services in the “rent-to-rent” market of the furniture rental industry. The Buffalo News and BH Media Group, Inc. are publishers of 31 daily and 43 weekly newspapers.

CORT商务服务公司是一家领先的全国性租赁搬迁服务提供商,在家具租赁行业的“租赁到租赁”市场提供租赁家具、配件和相关服务。布法罗新闻和BH传媒集团是31家日报和43家周报的出版商。

【WPLG, Inc】

WPLG, Inc. is an ABC affiliate broadcast station in Miami, Florida and Charter Brokerage is a leading non-asset based third party logistics provider to the petroleum and chemical industries.

wplg,inc.是美国广播公司(abc)在佛罗里达州迈阿密的分支广播电台,charter brokerage是石油和化工行业领先的非资产第三方物流提供商。

10、零售商业

Berkshire’s retailing businesses include automotive, home furnishings and several other operations that sell various consumer products to consumers. Berkshire’s retailing businesses employ approximately 29,000 people.

伯克希尔的零售业务包括汽车、家装和其他一些向消费者销售各种消费品的业务。伯克希尔的零售业雇佣了大约2.9万人。

Our retailers include Berkshire Hathaway Automotive (“BHA”). BHA includes over 80 auto dealerships that sell new and pre-owned automobiles, and offer repair services and related products. BHA also operates two insurance businesses, two auto auctions and an automotive fluid maintenance products distributor. Our retailing businesses also include four home furnishings retailing businesses (Nebraska Furniture Mart, R.C. Willey, Star Furniture and Jordan’s), which sell furniture, appliances, flooring and electronics.

公司的零售商包括伯克希尔哈撒韦汽车公司(“BHA”)。BHA包括80多家汽车经销商,销售新车和二手车,并提供维修服务和相关产品。BHA还经营两项保险业务、两项汽车拍卖和一项汽车液体保养产品分销商。公司的零售业务还包括四家家居用品零售业务(内布拉斯加州家具市场、R.C.威利、星光家具和乔丹),销售家具、电器、地板和电子产品。

Other retailing businesses include three jewelry retailing businesses (Borsheims, Helzberg and Ben Bridge), See’s Candies (confectionary products), Pampered Chef (high quality kitchen tools), Oriental Trading Company (party supplies, school supplies and toys and novelties) and Detlev Louis Motorrad (“Louis”), a Germany-based retailer of motorcycle accessories.

其他零售业务包括三家珠宝零售业务(Borsheims、Helzberg和Ben Bridge)、See's Candies(糖果产品)、Pamped Chef(优质厨房工具)、Oriental Trading Company(派对用品、学校用品、玩具和新奇事物)和Detlev Louis Motorrad(“Louis”),一家总部位于德国的摩托车配件零售商。

Revenues of the retailing group were approximately $15.6 billion in 2018, an increase of $542 million (3.6%) compared to 2017. BHA’s revenues, which represented approximately 63% of the aggregate retailing revenues in each of the past three years, increased 4.0% in 2018 as compared to 2017. The increase derived primarily from increased pre-owned vehicle sales and service contract revenues. Revenues from new vehicle sales were relatively unchanged.

零售集团在2018的收入约为156亿美元,同比增长3.6%。在过去三年中,伯克希尔哈撒韦汽车公司的收入占总零售收入的大约63%,相比于2017,在2018增加了4%。增加的主要原因是二手车销售和服务合同收入增加。新车销售收入相对不变。

Pre-tax earnings of the retailing group were $860 million in 2018, an increase of $75 million (9.6%) over 2017.

2018年,零售集团税前利润为8.6亿美元,同比增长9.6%。

汽车

【Berkshire Hathaway Automotive】

Berkshire acquired a group of affiliated companies referred to as the Berkshire Hathaway Automotive Group, Inc. (BHA) in 2015. BHA is one of the largest automotive retailers in the United States, currently operating 108 new vehicle franchises through 82 dealerships located primarily in major metropolitan markets in the United States. The dealerships sell new and used vehicles, vehicle maintenance and repair services, extended service contracts, vehicle protection products and other aftermarket products. BHA also arranges financing for its customers through third-party lenders. BHA operates 29 collision service centers directly connected to the dealerships’ operations and owns and operates two auto auctions and a fluid maintenance products distribution company.

伯克希尔在2015年收购了一家被称为伯克希尔哈撒韦汽车集团(BHA)的关联公司。伯克希尔哈撒韦汽车集团是美国最大的汽车零售商之一,目前通过主要位于美国主要大都市市场的82家经销商经营108家新车专营权。经销商销售新车和二手车、车辆保养和维修服务、延长服务合同、车辆保护产品和其他售后产品。伯克希尔哈撒韦汽车集团还通过第三方贷款人为客户安排融资。伯克希尔哈撒韦汽车集团运营29个与经销商运营直接相关的碰撞服务中心,拥有并运营两个汽车拍卖和一个流体维护产品分销公司。

Dealership operations are highly concentrated in the Arizona and Texas markets, with approximately 70% of dealership-related revenues derived from sales in these markets. BHA currently maintains franchise agreements with 27 different vehicle manufacturers, although it derives a significant portion of its revenue from the Toyota/Lexus, General Motors, Ford/Lincoln, Nissan/Infiniti and Honda/Acura brands. Approximately 90% of BHA’s annual revenues are from dealerships representing these manufacturers.

经销商业务高度集中在亚利桑那州和德克萨斯州市场,约70%的经销商相关收入来自这些市场的销售。伯克希尔哈撒韦汽车集团目前与27家不同的汽车制造商保持着特许经营协议,尽管它的大部分收入来自丰田/雷克萨斯、通用汽车、福特/林肯、日产/英菲尼迪和本田/讴歌品牌。伯克希尔哈撒韦汽车集团年收入的大约90%来自代表这些制造商的经销商。

BHA also develops, underwrites and administers various vehicle protection plans as well as life and accident and health insurance plans sold to consumers through BHA’s dealerships and third party dealerships. BHA also develops proprietary training programs and materials, and provides ongoing monitoring and training of the dealership’s finance and insurance personnel.

伯克希尔哈撒韦汽车集团还开发、承保和管理各种车辆保护计划,以及通过BHA的经销商和第三方经销商销售给消费者的人寿、意外和健康保险计划。BHA还制定专有培训计划和材料,并对经销商的财务和保险人员进行持续监控和培训。

家具零售

The home furnishings businesses consist of Nebraska Furniture Mart (“NFM”), R.C. Willey Home Furnishings (“R.C. Willey”), Star Furniture Company (“Star”) and Jordan’s Furniture, Inc. (“Jordan’s”). These businesses offer a wide selection of furniture, bedding and accessories. In addition, NFM and R.C. Willey sell a full line of major household appliances, electronics, computers and other home furnishings and offer customer financing to complement their retail operations.

家装业务包括内布拉斯加州家具市场(“NFM”)、R.C.威利家装(“R.C.威利”)、Star家具公司(“Star”)和Jordan's Furniture,Inc.(“Jordan's”)。这些企业提供各种家具、床上用品和配件。此外,NFM和R.C.Willey还销售全系列主要家用电器、电子产品、计算机和其他家居用品,并为客户提供融资,以补充其零售业务。

NFM operates its business from three large retail complexes, which include warehouse and administrative facilities in Omaha, Nebraska, Kansas City, Kansas and The Colony, Texas a suburb of Dallas, which opened in 2015. These three sites include approximately 1.5 million square feet of retail space. NFM is the largest furniture retailer in each of these markets. NFM also owns Homemakers Furniture located in Des Moines, Iowa, which has approximately 215,000 square feet of retail space.

NFM的业务来自三个大型零售综合体,其中包括奥马哈、内布拉斯加州、堪萨斯城、堪萨斯城和德克萨斯州殖民地(达拉斯郊区)的仓库和行政设施,2015年开业。这三块地的零售面积约为150万平方英尺。NFM是这些市场中最大的家具零售商。NFM还拥有位于爱荷华州得梅因市的家庭主妇家具,拥有约215000平方英尺的零售空间。

【R.C. Willey】

R. C. Willey, based in Salt Lake City, Utah, is the dominant home furnishings retailer in the Intermountain West region of the United States. R.C. Willey currently operates 12 retail stores and three distribution centers. These facilities include approximately 1.5 million square feet of retail space with six stores located in Utah, one store in Idaho, three stores in Nevada and two stores in California.

总部位于犹他州盐湖城的R.C.威利是美国西部山区的主要家装零售商。R.C.威利目前经营着12家零售店和3个配送中心。这些设施包括大约150万平方英尺的零售空间,其中6家店位于犹他州,1家店位于爱达荷州,3家店位于内华达州,2家店位于加利福尼亚州。

【Jordan】

Jordan’s operates a retail furniture business from six locations with approximately 770,000 square feet of retail space in stores located in Massachusetts, New Hampshire, Rhode Island and Connecticut. The retail stores are supported by an 800,000 square foot distribution center in Taunton, Massachusetts. Jordan’s is the largest furniture retailer, as measured by sales, in Massachusetts and New Hampshire. Jordan’s is well known in its markets for its unique store arrangements and advertising campaigns.

Jordan's在马萨诸塞州、新罕布什尔州、罗德岛州和康涅狄格州的六个地方经营家具零售业务,零售面积约77万平方英尺。这些零售店由位于马萨诸塞州陶顿的80万平方英尺的配送中心提供支持。以销售额衡量,Jordan's是马萨诸塞州和新罕布什尔州最大的家具零售商。Jordan's以其独特的店铺安排和广告活动而闻名于世。

【Star】

Star’s retail facilities include about 700,000 square feet of retail space in 11 locations in Texas with eight in Houston. Star maintains a dominant position in each of its markets.

Star的零售设施包括约70万平方英尺的零售空间,分布在德克萨斯州的11个地方,其中8个位于休斯顿。Star在其每个市场上都保持着主导地位。

珠宝

【Borsheim Jewelry Company, Inc】

Borsheim Jewelry Company, Inc. (“Borsheims”) operates from a single store in Omaha, Nebraska. Borsheims is a high volume retailer of fine jewelry, watches, crystal, china, stemware, flatware, gifts and collectibles.

博斯海姆珠宝公司在内布拉斯加州奥马哈的一家商店经营。博斯海姆是一家高销量的珠宝、手表、水晶、瓷器、文具、餐具、礼品和收藏品零售商。

【Helzberg’s Diamond Shops, Inc】

Helzberg’s Diamond Shops, Inc. (“Helzberg”) is based in North Kansas City, Missouri, and operates a chain of 217 retail jewelry stores in 36 states, which includes approximately 500,000 square feet of retail space. Helzberg’s stores are located in malls, lifestyle centers, power strip centers and outlet malls, and all stores operate under the name Helzberg Diamonds® or Helzberg Diamonds Outlet®.

赫尔兹堡钻石商店有限公司总部位于密苏里州堪萨斯城北部,在36个州经营着217家珠宝零售连锁店,其中包括约50万平方英尺的零售空间。赫尔兹堡的商店位于购物中心、生活中心、电源线中心和插座购物中心,所有商店都以“赫尔兹堡钻石”或“赫尔兹堡钻石插座”的名义营业。

【The Ben Bridge Corporation】

The Ben Bridge Corporation (“Ben Bridge Jeweler”), based in Seattle, Washington, operates a chain of 95 upscale retail jewelry stores located in 11 states primarily in the Western United States and in British Columbia, Canada. Forty-six of its retail locations are concept stores that sell only PANDORA jewelry. Principal products include finished jewelry and timepieces. Ben Bridge Jeweler stores are located primarily in major shopping malls.

总部位于华盛顿州西雅图的Ben Bridge公司(“Ben Bridge Jeweler”)在11个州经营着95家高档珠宝零售连锁店,主要分布在美国西部和加拿大不列颠哥伦比亚省。其46家零售店是仅销售潘多拉珠宝的概念店。主要产品包括成品首饰和钟表。本桥珠宝店主要位于各大商场。

糖

【See’s Candies】

See’s Candies (“See’s”) produces boxed chocolates and other confectionery products with an emphasis on quality and distinctiveness in two large kitchens in Los Angeles and San Francisco and one smaller facility in Burlingame, California. See’s operates approximately 250 retail and quantity discount stores located mainly in California and other Western states. See’s revenues are highly seasonal with nearly half of its annual revenues earned in the fourth quarter.

See's Candies(“See's”)生产盒装巧克力和其他糖果产品,重点放在洛杉矶和旧金山的两个大型厨房和加利福尼亚州伯林盖姆的一个小型设施的质量和独特性上。See's主要在加利福尼亚州和其他西部州经营大约250家零售和数量折扣店。SEE的收入具有很强的季节性,其年收入的近一半来自第四季度。

厨具

【Pampered Chef, Ltd】

The Pampered Chef, Ltd. (“Pampered Chef”) is a premier direct seller of distinctive high quality kitchenware products with operations in the United States, Canada and Germany. Pampered Chef’s product portfolio consists of approximately 400 Pampered Chef® branded kitchenware items in categories ranging from stoneware and cutlery to grilling and entertaining. Pampered Chef’s products are available online as well as through a sales force of independent cooking consultants.

Pampeed Chef,Ltd.是一家在美国、加拿大和德国开展业务的优质厨具产品的主要直销商。Pampered Chef's Product Portfolio由大约400件Pampered Chef品牌厨房用品组成,种类从石器和餐具到烧烤和娱乐。

文具

【Oriental Trading Company】

Oriental Trading Company (“OTC”) is a leading multi-channel retailer and online destination for value-priced party supplies, arts and crafts, toys and novelties, school supplies, educational games, patient giveaways and personalized products.

东方贸易公司(“OTC”)是一家领先的多渠道零售商和提供有价值的派对线上用品、工艺品、玩具和新奇物品、学校用品、教育游戏、患者赠品和个性化产品。

OTC, headquartered in Omaha, Nebraska, serves a broad base of nearly four million customers annually, including consumers, schools, churches, non-profit organizations, medical and dental offices and other businesses. OTC offers a unique assortment of over 50,000 fun products on its websites, including its flagship orientaltrading.com site and utilizes sophisticated digital and print marketing efforts to drive significant traffic and industry leading customer satisfaction.

OTC总部位于内布拉斯加州奥马哈,每年为近400万客户提供广泛的服务,包括消费者、学校、教堂、非营利组织、医疗和牙科办公室以及其他业务。OTC在其网站(包括旗舰网站orientaltrading.com)上提供了超过50000种有趣产品的独特分类,并利用复杂的数字和印刷营销努力来推动显著的流量和行业领先的客户满意度。

摩托车

【Detlev Louis Motorrad】

In April 2015, Berkshire acquired Detlev Louis Motorrad (“Louis”) which is headquartered in Hamburg, Germany. Louis is a leading retailer of motorcycle apparel and equipment in Europe. Louis carries over 32,000 different products from more than 600 manufacturers, primarily covering the clothing, technical equipment and leisure markets. Louis has over 80 stores in Germany, Austria and Switzerland and also sells through catalogs and via the Internet throughout most of Europe.

2015年4月,伯克希尔收购了总部位于德国汉堡的Detlev Louis Motorrad(“Louis”)。路易斯是欧洲领先的摩托车服装和设备零售商。路易拥有来自600多家制造商的3.2万种产品,主要覆盖服装、技术设备和休闲市场。路易在德国、奥地利和瑞士有80多家商店,还通过目录和互联网在欧洲大部分地区销售。

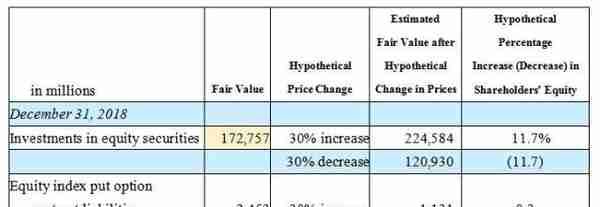

11、投资

2018年,公司投资的股票市场市值1727.57亿元,而伯克希尔公司的总资产为7078亿元,股票市值与总资产之比为24.4%。

股票投资

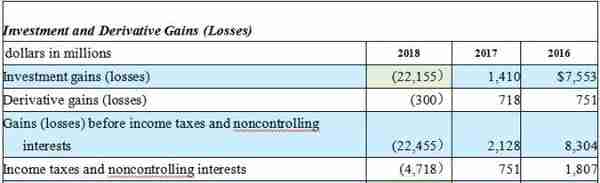

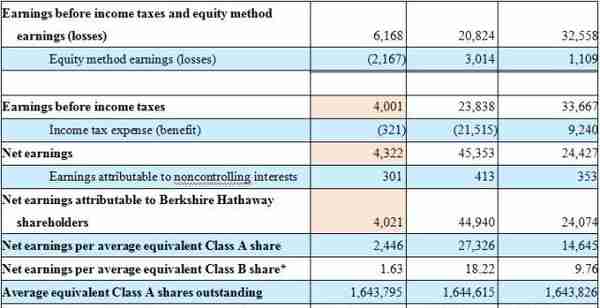

2018年,伯克希尔公司净利润大幅下降92%以上,主要原因是投资大幅亏损。

2017年,伯克希尔公司的投资收益为14.1亿美元,而2018年亏损高达221.55亿美元,相当于1551亿人民币;

on January 1, 2018, we adopted a new accounting pronouncement (“ASU 2016-01”), which requires the recognition of unrealized gains and losses arising from changes in market values of investments in equity securities in the Consolidated Statements of Earnings.

公司于2018年1月1日采用了新的会计公告,要求在合并收益表中确认权益性证券投资市值变动产生的未实现损益。

Pre-tax investment gains/losses reflected in earnings in 2018 included net unrealized losses of approximately $22.7 billion from investments in equity securities still held at December 31, 2018, reflecting the declines in securities prices in the fourth quarter.

在2018财年中反映的税前投资收益/亏损包括在2018年12月31日仍持有的证券投资中净未实现亏损约227亿美元,反映了第四季度证券价格的下跌。

根据公允价值计量方法,在2018年的投资亏损中,其中公司投资的卡夫亨氏股票出现大幅亏损;其中亏损非常严重的就是卡夫亨氏;

Since June 2013, Berkshire has maintained a significant investment in H.J. Heinz Holding Corporation (now The Kraft Heinz Company).

自2013年6月以来,伯克希尔一直对卡夫亨氏进行重大投资。

Kraft Heinz is one of the largest food and beverage companies in the world, with sales in approximately 190 countries and territories. Kraft Heinz manufactures and markets food and beverage products, including condiments and sauces, cheese and dairy meals, meats, refreshment beverages, coffee and other grocery products, throughout the world, under a host of iconic brands including Heinz, Kraft, Oscar Mayer, Philadelphia, Velveeta, Lunchables, Planters, Maxwell House, Capri Sun, Ore-Ida, Kool-Aid and Jell-O.

卡夫亨氏是世界上最大的食品和饮料公司之一,在大约190个国家和地区销售。卡夫亨氏在世界各地生产和销售食品和饮料产品,包括调味品和酱料、奶酪和乳制品、肉类、点心饮料、咖啡和其他食品杂货,旗下有许多标志性品牌,包括亨氏、卡夫、奥斯卡梅耶、费城、维维达、午餐、种植园、麦克斯韦庄园、卡普里太阳,Ore Ida,Kool Aid和Jell-O。

Berkshire currently owns 325,442,152 shares of Kraft Heinz common stock representing 26.7% of the outstanding shares. Shares of Kraft Heinz common stock are publicly-traded and the fair value of our investment at December 31, 2018 and 2017 was approximately $14.0 billion and $25.3 billion, respectively.

伯克希尔目前持有3.2544亿股卡夫亨氏普通股,占已发行股份的26.7%。 2018的公允价值为140亿美元,而2017年的公允价值是253亿美元,下降了80.7%,下降额度为113亿美元,占了2018年亏损的大部分。

从2017年2月22日到2019年10月16日,卡夫亨氏股价下跌了61.93%。而卡夫亨氏的股价下跌很大原因与公司大幅亏损有关,2018年卡夫亨氏亏损101.9亿美元,约合700多亿人民币。

不过作为长期投资的巴菲特,他的投资哲学是忽视短期股价波动,只要公司经营没出现不可逆转的恶化,那么他还是会选择继续持有的。

按照公允价值计算,由于卡夫亨氏的股价大幅下跌,导致伯克希尔公司的投资收益大幅亏损。但是如果根据权益法,把卡夫亨氏当成伯克希尔公司拟业务的一部分,那么亏损并没有那么严重。

We recorded equity method losses in 2018 of approximately $2.7 billion compared to earnings of $2.9 billion in 2017 and $923 million in 2016.

根据权益法,2018年投资卡夫亨氏损失约为27亿美元,而2017的收入为29亿美元,2016为9.23亿美元。

Our carrying value of this investment at December 31, 2018 and 2017 was approximately $13.8 billion and $17.6 billion, respectively.

2018年,伯克希尔公司投资卡夫亨氏的账面价值138亿美元,而2017年为176亿美元。

2019年半年报数据,卡夫亨氏的净利润为8.54亿元,业绩同比下降51.39%,但是亏损并没有继续。因此2018年的亏损是不可持续的;

至于为什么2018年卡夫亨氏为什么会亏损101.9亿美元,我们下一期再谈;

实际上2018年的亏损是不可持续的,因为2018年的前三季度公司还保持23.79亿元的净利润,所以2018年的亏损应该并非来至于正常经营所产生。

卡夫亨氏经过2018年和2019年的持续下跌,目前公司的每股净资产为42.25美元,而股价为27.8美元,市净率仅为0.66倍,已经相当便宜。

Our long-held acquisition strategy is to acquire businesses that have consistent earning power, good returns on equity and able and honest management.

伯克希尔公司的长期收购策略是收购具有持续盈利能力、良好的股本回报率和干练诚实的管理层的企业。

而且伯克希尔公司的持仓非常集中,对于优秀公司拟的股票会选择尽可能的买入,2018年在1727.57亿美元的投资中,68%的仓位集中在5只股票上。

除了卡夫亨氏股价下跌,其实苹果的股票在2018年也发生了下跌,不过2019年又震荡上行,创出了新高,因此2019年伯克希尔公司的投资收益应该表现会不错。根据公司今年的三季报来看,2019年公司净利润超过400亿美元,应该是无悬念的。

After-tax losses from investments and derivative contracts were $17.7 billion in 2018, which included after-tax losses of approximately $18 billion from changes in market values of our investments in equity securities held at December 31, 2018.

公司税后投资和衍生品合约的损失在2018美元为177亿美元,由于公司2018的股票证券投资的市场价值变化,其中税后损失约为180亿美元。

面对投资的股票下跌,伯克希尔公司的年报评论是:

We believe that investment gains/losses, whether realized from sales or unrealized from changes in market prices, are often meaningless in terms of understanding our reported consolidated earnings or evaluating our periodic economic performance. We continue to believe the amount of investment gains/losses included in earnings, including the changes in market prices for equity securities, in any given period has little analytical or predictive value.

我们认为,无论是从市场价格变化中实现的还是未实现的投资损益,在理解我们的合并收益表或评估我们的定期经济业绩方面通常都是毫无意义的。我们仍然认为在任何给定时期内分析或者预测投资收益金额,股价,几乎没有价值。

衍生品投资

As of December 31, 2018, the intrinsic value of our equity index put option contracts was approximately $1,653 million and our recorded liabilities at fair value were approximately $2,452 million.

截至2018,公司的股票指数看跌期权合约的内在价值约为16.53亿美元,而公司的公允价值负债约为24.52亿美元。

Derivative contracts produced pre-tax losses in 2018 of $300 million, which were primarily due to lower index values.

衍生工具合约在2018年产生了3亿美元的税前亏损,主要原因是指数值下降。

回购

Berkshire’s common stock repurchase program was amended on July 17, 2018, permitting Berkshire to repurchase its Class A and Class B shares at prices below Berkshire’s intrinsic value, as conservatively determined by Warren Buffett, Berkshire’s Chairman of the Board and Chief Executive Officer, and Charlie Munger, Vice Chairman of the Board. The program allows share repurchases in the open market or through privately negotiated transactions and does not specify a maximum number of shares to be repurchased. The program is expected to continue indefinitely. We will not repurchase our stock if it reduces the total amount of Berkshire’s consolidated cash, cash equivalents and U.S. Treasury Bills holdings below $20 billion. Financial strength and redundant liquidity will always be of paramount importance at Berkshire. Subsequent to the program amendment, in 2018, Berkshire repurchased shares of Class A and B common stock for an aggregate cost of approximately $1.3 billion.

伯克希尔普通股回购计划于2018年7月17日进行了修订,允许伯克希尔以低于伯克希尔内在价值的价格回购其A类和B类股票,这是伯克希尔董事会主席兼首席执行官沃伦•巴菲特(Warren Buffett)和董事会副主席查理•芒格(Charlie Munger)保守决定的。该程序允许在公开市场中进行股份回购或通过私人协商交易,并没有指定要回购的最大股份数。该计划预计将无限期地继续下去。如果伯克希尔的合并现金、现金等价物和美国国库券持有总额低于200亿美元,我们将不会回购我们的股票。财务实力和多余的流动性将永远是伯克希尔最重要的。在程序修正案之后,在2018,伯克希尔公司回购了A类和B类普通股的股票,其总成本约为13亿美元。

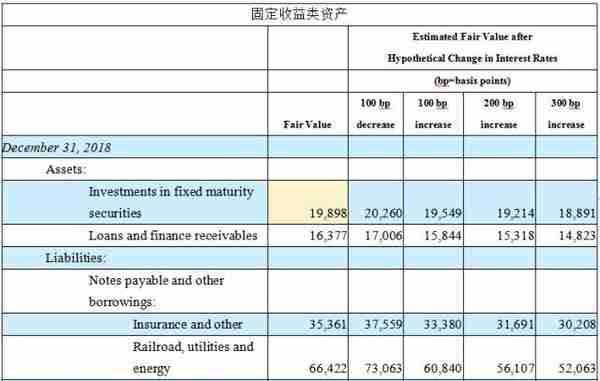

固定收益类投资

截止2018年,公司投资的固定收益类资产与198.98亿美元

公司投资哲学

Equity securities represent a significant portion of our investment portfolio. Strategically, we strive to invest in businesses that possess excellent economics and able and honest management, and we prefer to invest a meaningful amount in each investee. Consequently, equity investments are concentrated in relatively few issuers. At December 31, 2018, approximately 68% of the total fair value of equity securities was concentrated in five issuers.

权益证券在我们的投资组合中占很大比例。从战略上讲,我们努力投资于经济效益好、管理能力强、诚实守信的企业,我们更愿意对每个被投资方进行有意义的投资。因此,股权投资集中在相对较少的发行人身上。在2018,大约68%的权益证券的总公允价值集中在5只股票上。

We often hold our equity investments for long periods and short-term price volatility has occurred in the past and will occur in the future. We also strive to maintain significant levels of shareholder capital and ample liquidity to provide a margin of safety against short-term price volatility.

我们经常长期持有我们的股权投资,短期价格波动在过去和将来都会发生。我们还努力保持大量的资本和充足的流动性,以提供抵御短期价格波动的安全边际。

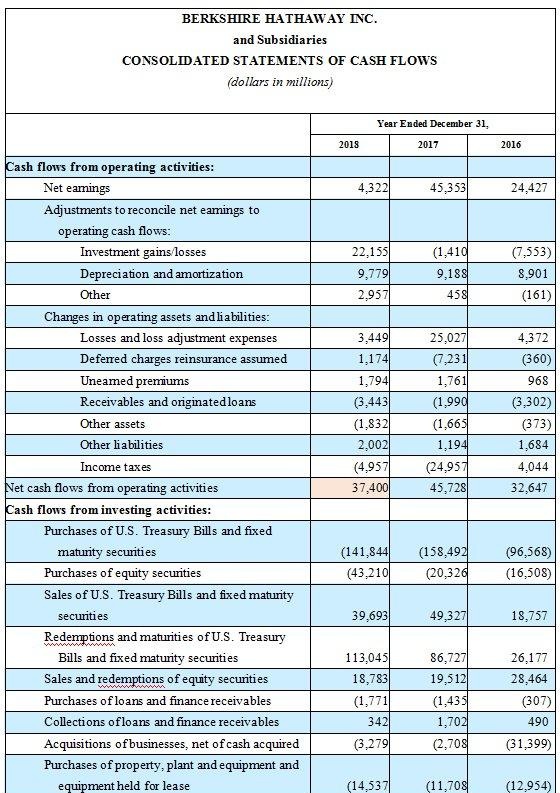

At December 31, 2018, our insurance and other businesses held cash, cash equivalents and U.S. Treasury Bills of approximately $109 billion, which included $85 billion in U.S. Treasury Bills. Investments in equity and fixed maturity securities (excluding our investment in Kraft Heinz) were approximately $193 billion.

截止2018年,公司持有的现金和现金等价物高达1090亿美元,包括850亿美元的国库券,还有权益和固定到期收益类证券1930亿美元。

伯克希尔公司看好的股票,可以说是长久持有,甚至公司的股价很高也继续持有,例如可口可乐和苹果公司的股票,目前市净率是非常高的,超过10倍,伯克希尔公司依然选择继续持有。对于这些股票,由于没有价格优势,因此伯克希尔公司宁可持有上千亿美国的货币资金,并且继续持有这些价格高的股票,但是并没有选择加仓。

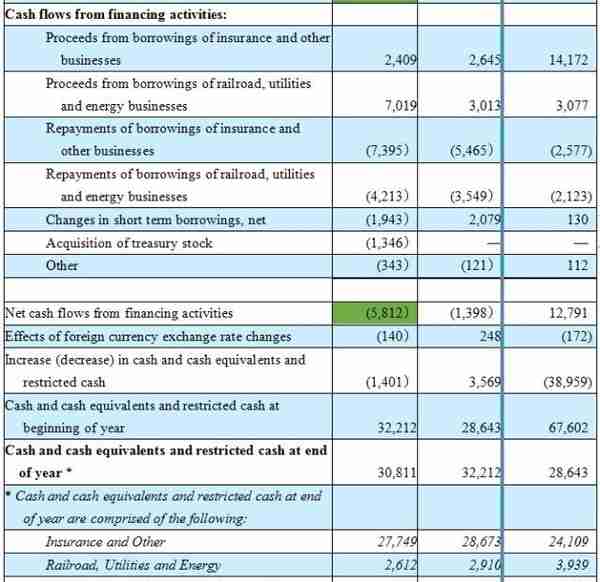

12、财报

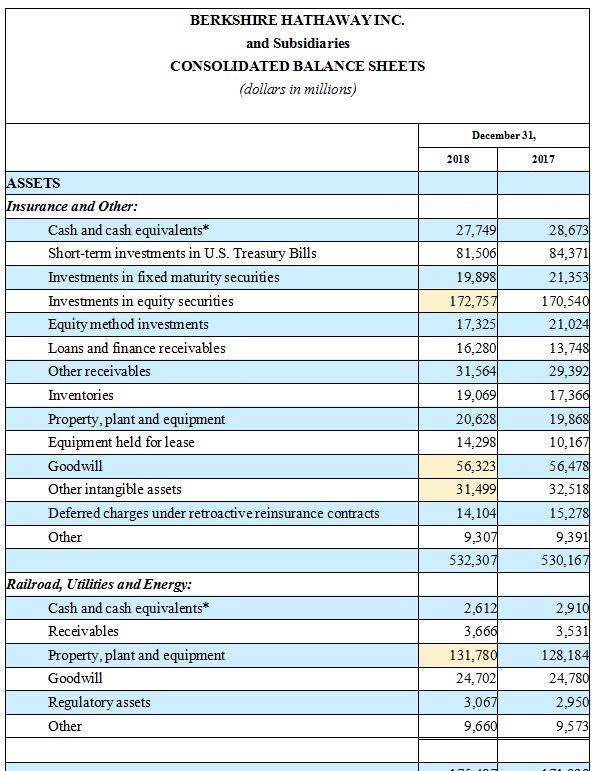

1、从伯克希尔公司的资产上来看,2018年货币资金为277.49亿美元,短期投资国库券为815.06亿美元,这两项加起来为1092.55亿美元,占公司总资产的15.44%。

2、另外,公司的权益类投资(股票投资)1727.57亿美元,占公司总资产的比率为24.4%。

由于公司有大量的货币资金,其实公司还可以选择继续加仓的。

但是大家都知道,2009年以来,美股进入十年大牛市。目前美股的价格已经很高,缺乏好的投资机会,所以伯克希尔公司才不得不持有大量的货币资金。

为了资金能够更高效的利用,伯克希尔公司2018年已经开启了股票回购的计划,2018年回购了13亿美元的股票。

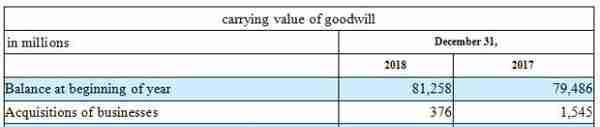

3、伯克希尔公司还有相当高的商誉,2018年伯克希尔公司的商誉为563.23亿美元,占总资产的8%,公司有71万的A股,相当于每股A股含有商誉7.9万的商誉。

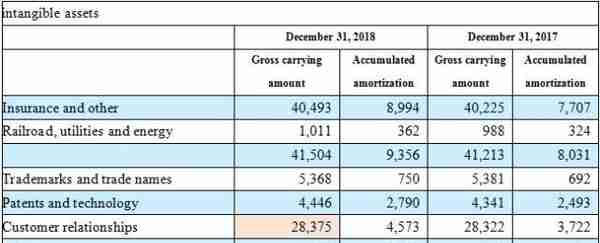

4、伯克希尔公司的无形资产为314.99亿美元,相当于每股A股有4.4万的无形资产。

不过即使去掉无形资产和商誉,伯克希尔公司的股票依然并不贵。

在安全性方面,2018年伯克希尔公司的总负债为3552.94亿美元,公司的总资产为7077.94亿美元,资产负债率为50.2%,债务规模并不高,而且由于公司有很高的货币资金,因此公司的安全性是相当高的。

2018 年,伯克希尔公司的净利润为43.22亿美元,相比于2017年的453.53亿美元下降了90.17%。其中投资亏损额度为221.55亿元,与2017年的净利润之比为48.85%。

公司业绩大跌主要是投资亏损,那么我们可以选择业绩较为正常的2016年作为参考。

2016年,伯克希尔公司归属上市公司股东的净利润为240.7亿美元,而公司的总资产为6209亿美元,净利润与总资产之比为3.88%,这个水平并不高。

2017年,伯克希尔公司的归属净利润为449.4亿美元,而总资产为7021亿美元,净利润与总资产之比为6.4%,而在2017年,公司的利润水平可以说是非常高的一年。

根据以上这些数据,我们发现随着伯克希尔公司的成长,目前公司的投资收益率其实下降非常明显。

并且由于缺乏优质的投资标的,伯克希尔公司不得不持有大量的货币资金。

就目前情况来看,如果伯克希尔公司要想保持投资吸引力,选择回购股票是一个不错的选择。所以在2018年,伯克希尔公司开启了股票回购的计划。

如果后续美国股市依然高位运行,依然缺乏好的投资机会,伯克希尔公司依然继续持有高额现金,那么可能会使得伯克希尔公司的净利润与总资产之比在相当长一段时间维持在低位;

在2018年,伯克希尔公司的净利润为40.21亿美元,而公司的总资产为7078亿美元,净利润与总资产之比仅为0.56%。即使公司投资收益并没有亏损221.55亿美元,那么利润与总资产之比顶多也就是3.7%。

随着伯克希尔公司的成长,我们认为公司的很难再长期实现净利润与总资产之比在10%以上.

另外,虽然2018年公司的净利润仅为40.21亿美元,但是公司经营活动产生的现金流量净额高达374亿美元,这是一个相当高的规模。

至于2018年第四季度股价下跌的问题,其实股价跌了还会涨回来嘛。并且伯克希尔公司的投资哲学是长期持有,不用过于在意短期股价波动。

不过,虽然按照经营获得产生的现金流量净额与总资产之比,2018年这一比值也仅为5.28%。未来伯克希尔公司要想在业绩上获得提升,更重要还是在投资收益上下功夫。

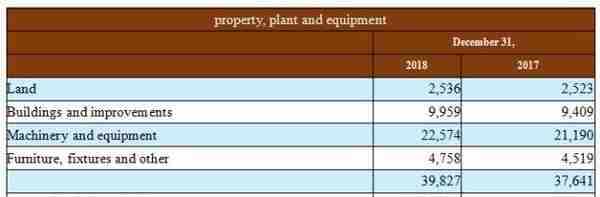

由于伯克希尔公司有大量铁路资产,2018年公司的地产、厂房和设备价值206.28亿美元,由于有庞大的固定资产,因此公司的折旧和减值往往也会比较高。

对于物业、厂房和设备,公用事业和能源公司减值16.31亿美元,铁路公司减值13.77亿,伯克希尔公司减值14.26亿,三项加起来44.34亿。

另外,2018年公司有810.25亿的商誉 ;

还有415.04亿的无形资产;因此后续也要注意公司的商誉减值和无形资产的摊销;

Intangible asset amortization expense was $1,393 million in 2018, $1,469 million in 2017 and $1,490 million in 2016.

2018年同时无形资产摊销费用为13.92亿美元;